Semimonthly payroll calculator

7-22 CHAPTER 616C - INDUSTRIAL INSURANCE. Daily rates are contractual and are based on the employees salary step and differentials if applicable.

Semi Monthly Timesheet Calculator With Overtime Calculations

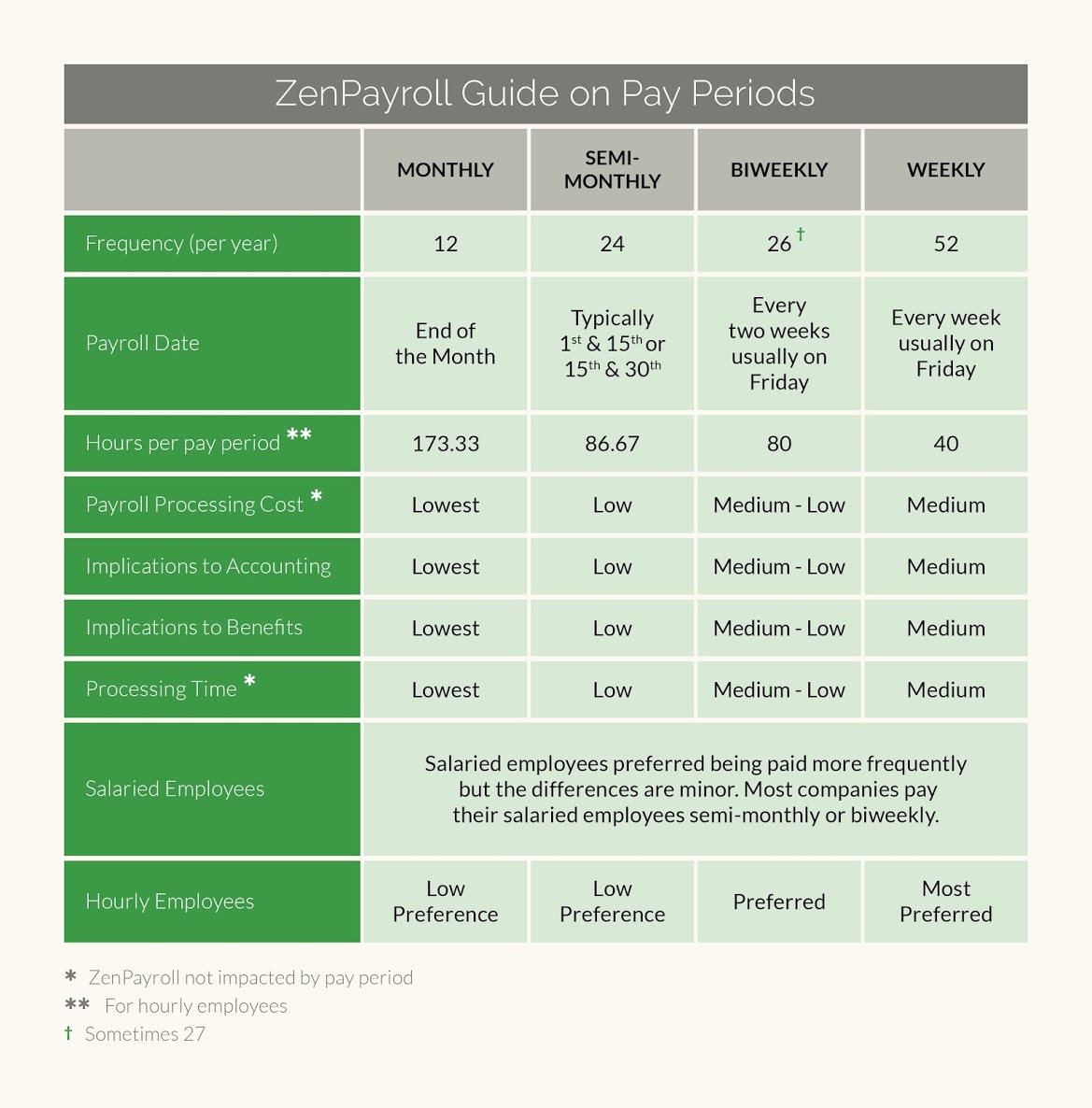

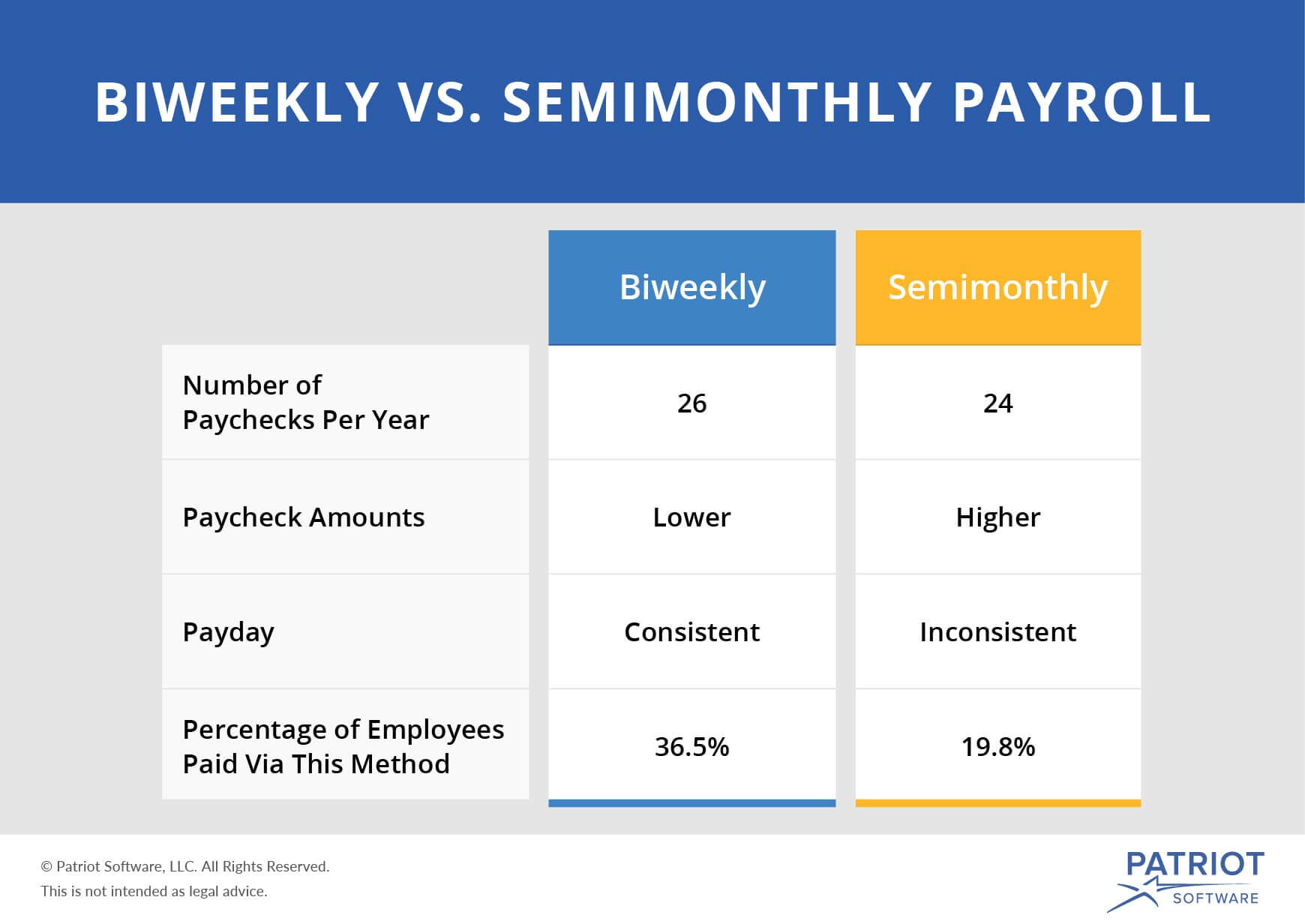

Tracking time on a bi-weekly or semi-monthly basis means your payroll department saves time on processing.

. 49808 plus 16923 for each dependent 53958 plus 18333 for each dependent 117500 127290. For single people married people or people filing as the head of household. BENEFITS FOR INJURY OR DEATH.

The day is consistent like each week pay is to be made on Fridays. Paychecks are mailed directly to the employees home on a semi-monthly schedule. W-4 exemptions lower your taxable income thus reducing the amount you pay in taxes each year.

PROVIDERS OF HEALTH CARE. Semimonthly pay periods are a less common option for small businesses and have its pros and cons. Submitting timesheets and reviewing documents less frequently gives your team more time to perfect processes that grow the business.

You can review account history and current transactions transfer funds between accounts inside and outside the bank place stop payments request copies of statements send customer service requests via secured email pay bills view images of. For this example if an employee makes an annual salary of 120000 and is being paid on a semimonthly schedule assuming a general pre determined 40 hours workweek- the calculation for their gross pay would be as follows. 120000 annual salary divided by 24 pays periods.

If you would like to learn how to do payroll yourself read on. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you would calculate as follows. 616C002 Adoption by reference of American Medical Associations Guides to the Evaluation of Permanent Impairment.

Employees receive the same amounts usually on the 15th and last day of the month. Semimonthly Number of Dependents Claimed on Statement Number of Dependents Claimed on Statement 9962. Part of learning how to do payroll is choosing a cycle for running payroll.

Employees with multiple employers may refer to our Completing a New MO W-4 If You Have More Than One Employer example to make changes to their Missouri W-4s. The date is consistent like each payment is to be done on the 15 th and 30 th of. 120000 24 5000.

You must determine your total allowances and multiply them by the withholding chart according to your pay period. The amount to be paid to employees on monthly payroll are higher. Monthly Semi-monthly Bi-weekly Hourly Each payment method has a different way for the calculation of wages thus for a payroll keeper it is important to know how.

Form W-4 lists the exemptions and withholding allowances that you might be able to claim. Common payroll cycles include. This bi-weekly time card calculator tracks two weeks of work at a time.

70 hours x 10 700 your gross semi-monthly pay. Payroll calculations can be particularly complex calculations because an organization may hire workers on different payment criteria. For daily weekly biweekly semimonthly or monthly pay schedules.

The calculator above and related tables below reflect 2022 monthly pay based on the 27 raise which was effective Jan. Multiply hours worked by your hourly rate. But if you pay monthly or semimonthly you may have to divide the number of available work hours in the month by the number of hours the employee worked on average to calculate your actual FTE.

Calculating payroll for employees. With semimonthly pay you will be distributing two checks per month resulting in 24 checks per year. The Per Diem Payroll is a semi-monthly payroll.

Active-duty orders will be paid semimonthly -- on the first. When you hop over to Publication 15-T youll notice that the IRS lists more than just two tablesInstead it lists tables for manual or automated payroll calculations. The payments to be made are higher than weekly payroll employees but lesser than those on monthly payroll.

Manually with software or with the help of a professional. Semimonthly pay is paid twice per month every month. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Online Banking gives you the power to access and manage nearly all your Citizens Bank accounts -- from one place. 862022 103220 PM NAC-616C Revised Date. Though seemingly simple and straightforward payroll is actually quite complex and requires a number of intricate moving parts for successful processing.

Using time tracking software like Homebase will allow you to run a historical report based on employee work history and status to gather the. A business can have employees being paid on the following basis. The Per Session Payroll is used to pay all pedagogic employees on an hourly or per session.

A word of warning. One of the most popular payroll cycles is. There are three traditional ways businesses can complete their payroll.

And for employees who submitted.

What Payroll Schedule Makes Sense For Your Business Guide When I Work

Payroll Calendar Calendar Template Monthly Calendar Template

2

Payroll Calendar Calendar Template Monthly Calendar Template

What Is A Pay Period Free 2022 Pay Period Calendars

Annual Salary To Semimonthly Paycheck Conversion Calculator

Employee Vacation Benefits Tracking Template Sick Time Sick Leave Vacation Calendar

How Many Pay Periods In A Year Biweekly Pay How Many Paychecks In A Year

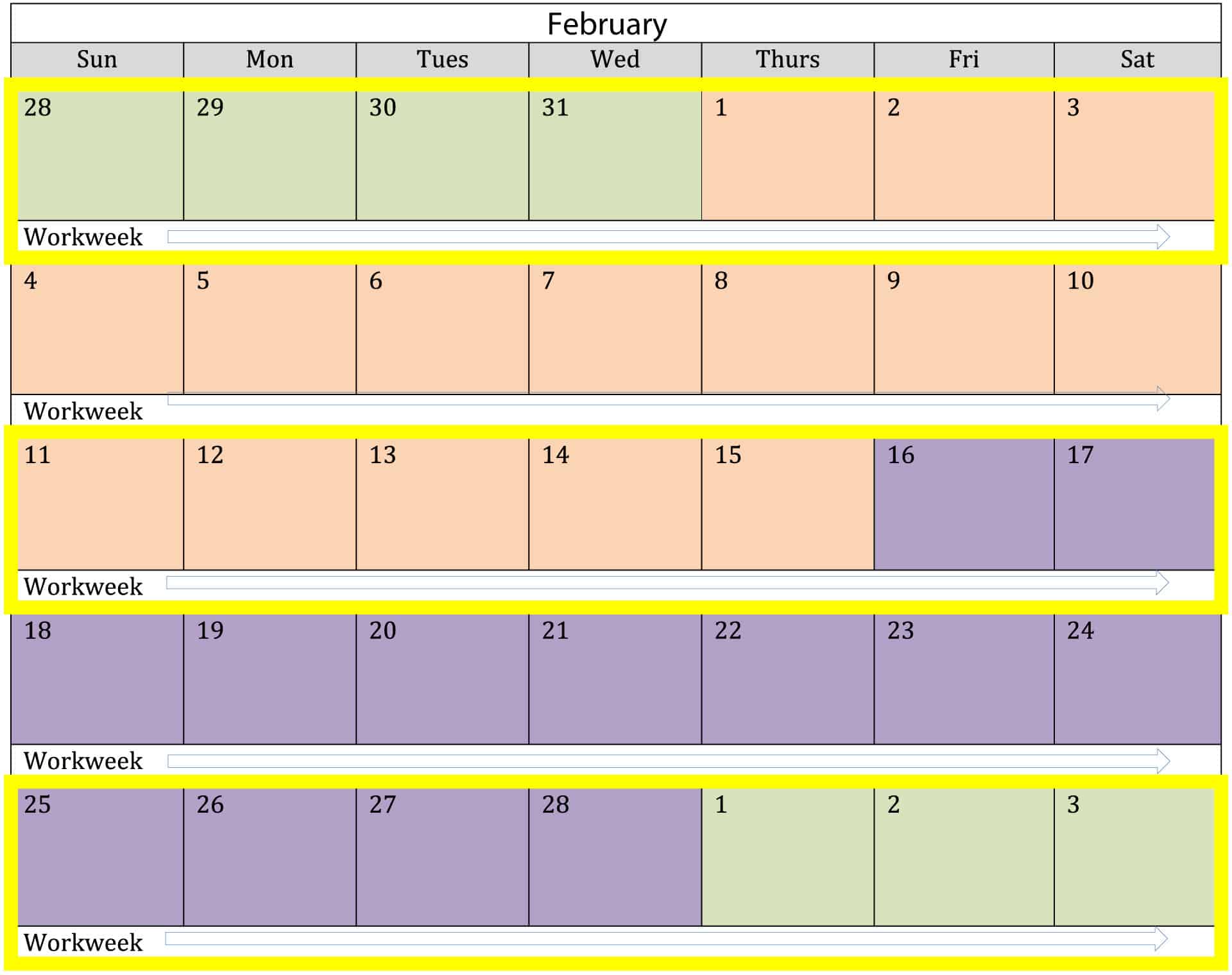

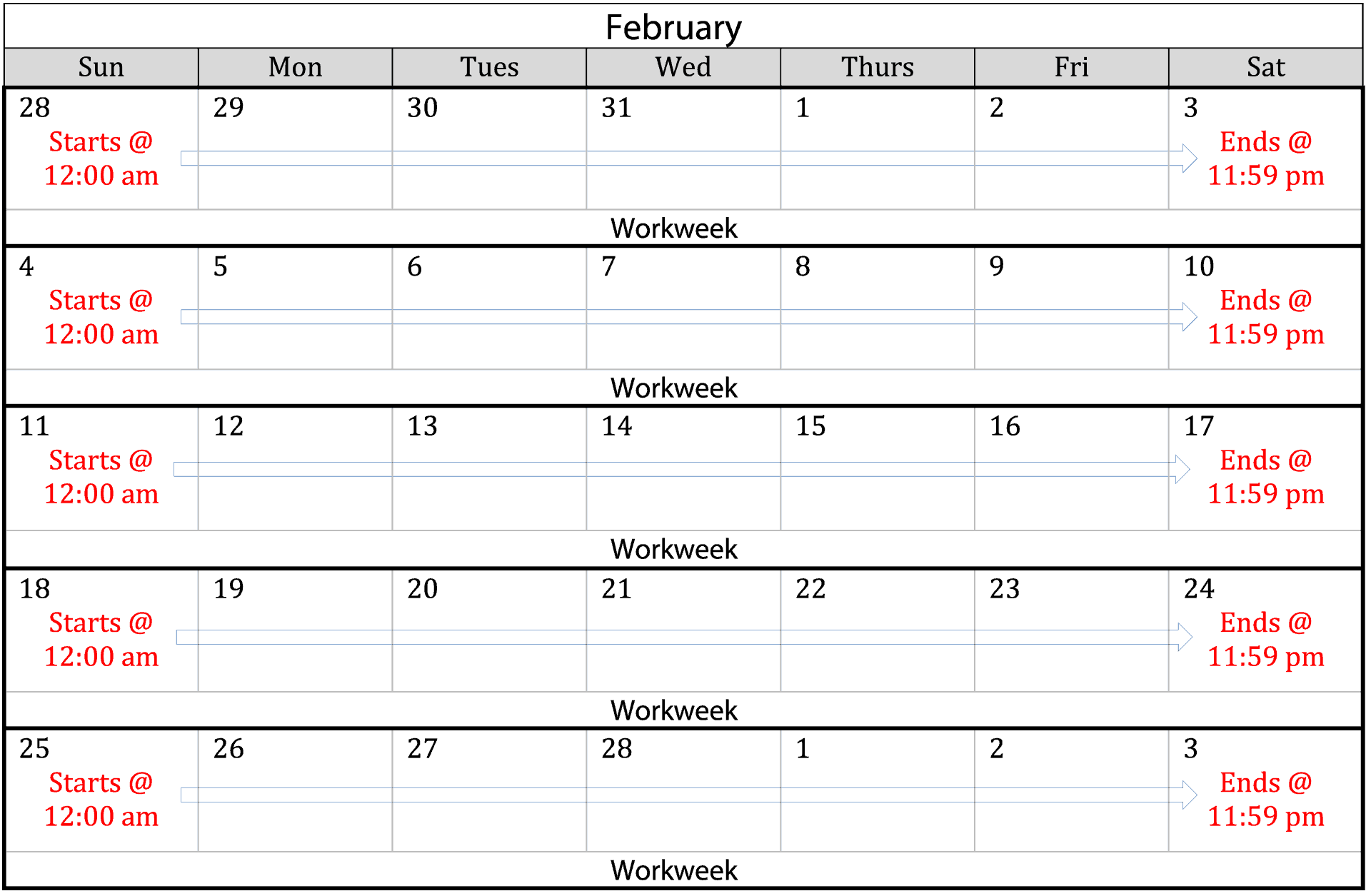

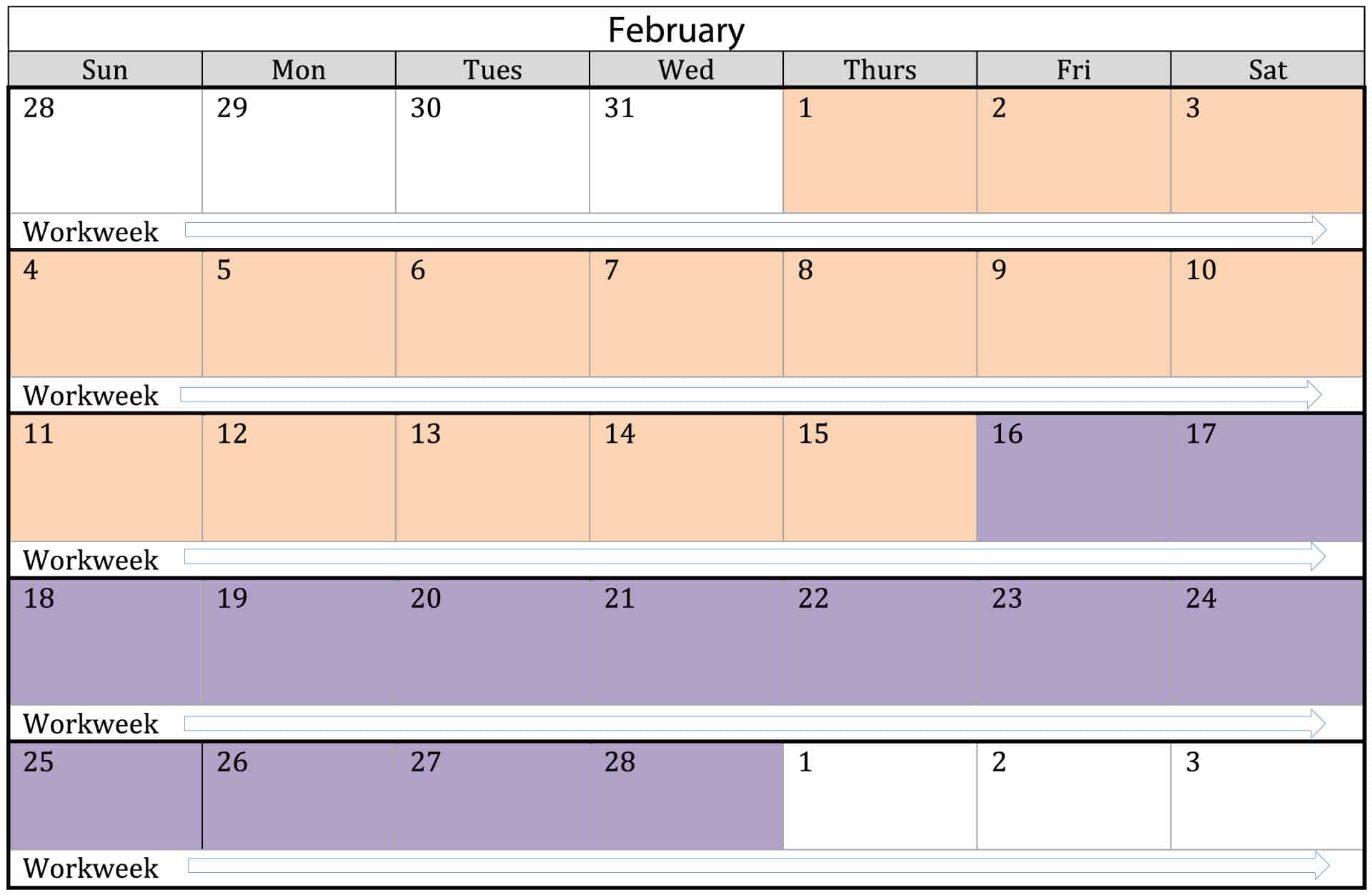

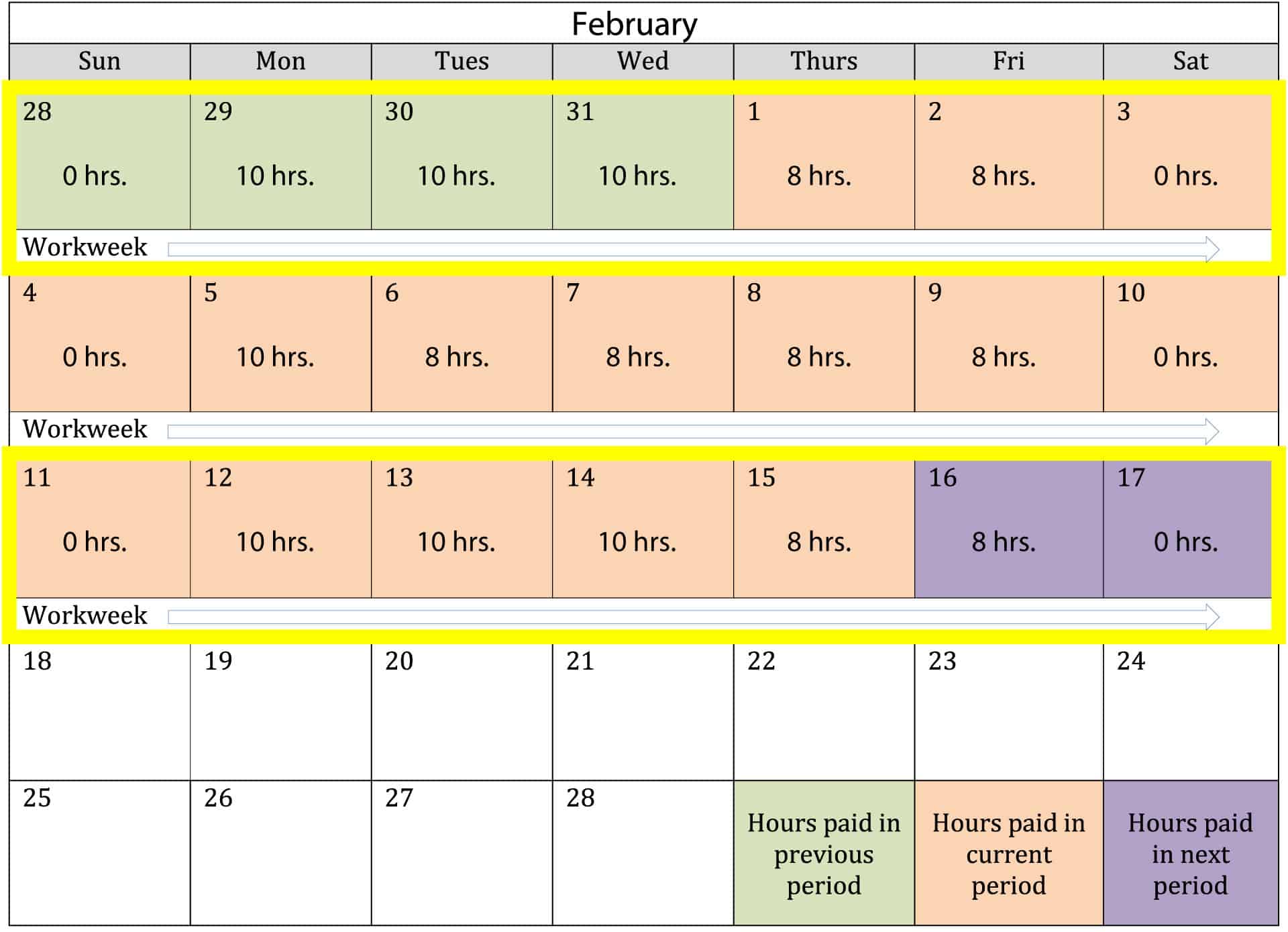

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Monthly Calendar No Year Payroll Calendar Calendar Template Monthly Calendar Template

Elaws Flsa Overtime Calculator Advisor

The Pros And Cons Biweekly Vs Semimonthly Payroll

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

2

Biweekly Budget Biweekly Budget Excel Template Budget Spreadsheet Template Excel Budget Excel Budget Template

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule